Please confirm your province to show the products and offers available to you.

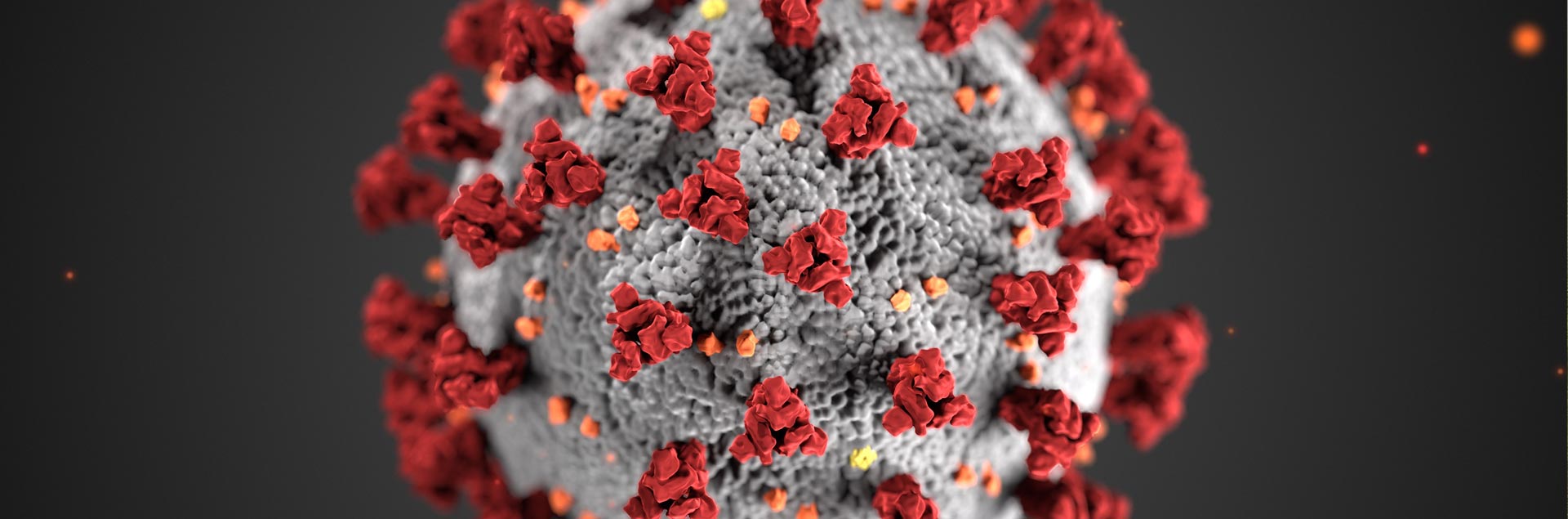

Like you, we have been carefully watching the situation on the COVID-19 and the developments in terms of the requirements for implementing social distancing strategies as recommended by government health agencies.

To assist the government in their efforts to control the spread of COVID-19, we have implemented a work from home strategy for many of our employees. We have also limited access to all Portage Mutual buildings. Even with this strategy in effect, we are committed to maintaining our service levels to our customers and broker partners to the highest standards possible.

Please Note: When looking to report a claim or when making a payment inquiry, please try phoning your insurance brokerage first.

Should you require to make a claim, please find the following phone numbers listed by region:

We understand that payment of your account may become a concern for you during this pandemic. If you are unable to make your regularly scheduled payment, please contact us at the email address below to make alternate arrangements at accounts.mb@portagemutual.com.

We are deeply concerned about this increasingly difficult situation and therefore are continually looking at ways to provide support and relief for our communities.

If you have questions related to COVID-19 at this time, please see the Frequently Asked Questions below or email info@portagemutual.com.

Portage Mutual Insurance appreciates the challenges our customers and their families are facing during these unprecedented times. We are working diligently to understand and respond to the change in circumstances that has occurred from the effects of COVID-19. As always we are committed to assisting our policyholders in any way we can, which is something we have prided ourselves in doing since 1884. To this end, we have put together a FAQ to help keep you informed as the situation evolves.

Portage Mutual is continually re-assessing our procedures to follow the most recent recommendations made by government authorities. We are proud to work side by side with our broker partners to continually deliver the quality service Canadians deserve during these challenging times.

Always contact your insurance broker to obtain their professional advice and guidance on all insurance matters.

Yes. If your vehicle use has changed, please consult with your insurance broker on how the change may affect your automobile insurance premiums.

If you are an existing Portage Mutual policyholder who’s means of making a living have been directly impacted by the COVID-19 pandemic, we will continue to provide coverage for a change in your driving use while delivering on behalf of your existing employer or for making deliveries on a volunteer basis even if receiving compensation for mileage.

Should a customer start to make deliveries for restaurants for compensation other than just mileage, no coverage would be provided as this is a restricted class for Portage Mutual Insurance.

Please inform your broker of any change in driving status. We recognize the need to provide essential services so we are pleased to extend coverage to your personal vehicle for commuting purposes without changing your premium. Once social distancing guidelines have changed, please inform your broker of your driving status.

Yes. Many businesses have been closed as a result of government mandated closures which began on March 16, 2020. Until further notice, we will not consider those businesses that have been mandated to shut down because of COVID-19 to be vacant or unoccupied. It is our expectation that while a business is closed, that the insured or another competent individual will attend the premises at least twice a week to confirm that there has not been any damage.

Other loss prevention measures that should be considered would be:

Our business interruption wordings like most other insurers do not cover losses as a result of the COVID-19 pandemic.

Where necessary, with claims already underway and for policyholders that are unable to have their car or home repaired due to vendor closures or parts and materials unavailability, please contact your adjuster to discuss different options.

If a policyholder is working remotely as a result of the COVID-19 outbreak, there is a defined amount of coverage on certain types of policies for books, tools, and instruments pertaining to a business, profession, or occupation. Please contact your insurance broker to verify the type of policy you have and to explain the limits of insurance.